Click on a question to expand the answer text.

We suggest you use the allocation models below for accounts with $4,000 or less value. These allocations will not change often, however, it will still be your responsibility to check back with Tree SAApp (a couple times per year) for allocation change suggestions. This document will be available anytime on TreeSAApp.com and located in the FAQ section.

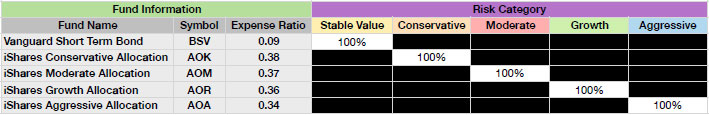

Regarding the allocations; with account values below $4,000 the Tree SAApp allocation algorithm will not be able to efficiently divide your assets to fit within our target allocation models. So, we suggest using fully allocated and diversified Exchange Traded Funds (ETF’s) for 100% of the account until the account value passes $4,000. Once your account value passes $4,000, Tree SAApp’s algorithm will help you allocate into a lower cost and likely more effective diversified ETF allocation.

Please use the appropriate risk tolerance group for your allocation suggestion:

Each of the ETFs above are also included in TD Ameritrade’s Commission-Free ETFs list. Be sure your account is enrolled in the TD Ameritrade Commission-Free ETF program before you allocate in the suggested allocation model. Use the Tree SAApp videos found in the HELP area under HowTo Videos to get instructions on how to place your trades at TD Ameritrade.

Need help? Contact us using the following link or send a message direct to support@treesaapp.com.

I create these portfolios using my experience and training, Blackrock Investment’s Model Portfolios (www.blackrock.com) and/or the help of other industry pros/peers. They are similar to the portfolios I use in my financial practice, but are designed to be used by do-it-yourself investors who are cost conscious and not looking for an active trading strategy. And, in case you are wondering, the difference between Tree SAApp and an active trading strategy is Tree SAApp is not a market timing strategy. It is better suited for long term investors who are cost conscious and eager to learn more about managing their own investments.

No. The only income earned by me or my firm is the monthly or annual fee charged to subscribers of Tree SAApp. Any additional fees or commissions charged are between you and your brokerage firm (such as TD Ameritrade/E*Trade, etc.). To help minimize brokerage firm transaction ticket charges, Tree SAApp is designed to give preferential weight to exchange traded funds (ETFs) offered without transaction fees at TD Ameritrade. Please read more about TD Ameritrade’s commission free ETF program here. I highly suggest you open your account(s) at TD Ameritrade and enroll for this program to optimize your use of my portfolio suggestions.

I am committed to simplicity and efficiency. We created Tree SAApp to offer you a sophisticated portfolio solution which changes as needed. I don’t suggest trades for fun, I suggest allocation trades when I think they are necessary. Most months there should be no changes while other months may have multiple changes to the investments. I think it is fair to assume fewer than 10 changes per year. That number may adjust depending on changing market conditions, your risk tolerance, portfolio selection, etc.

First, your Tree SAApp investment profile tool will not be investment advice; rather, it will provide you with suggestions for portfolio design. You can choose to follow the suggestions verbatim or modify as you choose. I strongly suggest you use them and follow them as indicated. From my professional experience, one of the most common attributes of a failed investor is the inability to stick to a strategy. This tool should be viewed as a strategy and should be followed consistently through rising and declining market conditions. Timing the Tree SAApp strategies is NOT RECOMMENDED. This is a common practice of DIY investors, when they buy and sell a stock or mutual fund trying to time the price volatility to capture gains or avoid losses. My portfolios have this strategy built in by me and my team. So, trying to buy and sell our suggested portfolio mix (timing), is the same as "timing a timing" strategy. It undermines the purpose of this tool and “the strategy” I developed. If you commit to using it, then follow it without changing anything.

Second, the low cost of Tree SAApp offers investors with an alternative to a comprehensive investment advisory relationship which inherently costs more. However, I do not think Tree SAApp is a replacement to a quality relationship with an experienced and well-rounded financial advisor. The bottom line; I know, from experience, most people would benefit greatly from a relationship with a quality advisor, but I also know many people do not make the time to find and develop this type of relationship. So, I am providing a solution to the investment component. If you would like a referral to a quality advisor in your area, please send me a message, I will help you find one, even if it means you leave Tree SAApp. At the end of this, I want you to succeed.

I think most people do itemize this expense on their tax return as investment advice. However, I am not permitted to provide tax advice, so this is a discussion you and your tax advisor should have.

Assessing investor risk tolerance is perhaps the most important aspect to portfolio design, but is typically not given enough consideration by investors. Saying you are conservative makes me wonder “how” conservative you are? Are you completely risk adverse and can handle no value losses? If so, then my suggestions are not designed for you. I offer various suggested portfolio allocations to align with different types of risk tolerances: defensive, conservative, moderate, moderately aggressive, aggressive and speculative. Each portfolio is appropriately named and described, but each is also suggesting an investment allocation which will fluctuate in value. This conservative allocation is appropriate for an investor with low risk tolerance, but is designed to give them cautious exposure to potential value increases. Every investor needs to know that all investing involves some level of risk. It is your job to discover how much risk you can tolerate and to understand that a reduced level of risk translates into a reduced reward expectation. Our app provides a scored risk tolerance assessment questionnaire for those that are not sure what investment strategy to choose. When setting up your free account you will have a chance to use the risk assessment tool to see how it works.